how much is inheritance tax in wv

2193 million Washington DC District of Columbia. Estate and Inheritance Taxes.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

. No estate tax or inheritance tax Washington. The top estate tax. That means if you inherit property either real property personal property or.

6 on taxable income between 40001 and 60000. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023. 45 percent on transfers to direct descendants and lineal heirs.

The net estate is the fair market value of all. Gift tax and inheritance tax in West Virginia. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of.

However state residents must remember to take into account the federal estate tax if their estate or the estate. Effective Jan 1 2013 if Congress does nothing about the federal estate tax then the tax will return to the status that existed on Jan 1 2000 which would make the estate tax. 56 million West Virginia.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. The top estate tax rate is 20 percent exemption threshold. 45 percent on transfers to direct descendants.

However if the decedent was a citizen or resident of the US the decedent has a. Today Virginia no longer has an estate tax or inheritance tax. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

Heres a breakdown of each states inheritance tax rate ranges. Twelve states and the District of Columbia also charge estate taxes though the sizes of the estates they exclude are much smallerfrom about 1 million to 7 million. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt.

However today people who have sufficient estate in West Virginia may still be responsible for the federal estate tax once the inheritance exceeds the federal estate tax. When a West Virginia resident inherits the real estate personal or other property or intangible assets like financial accounts or cash from a resident of the state that does have. West Virginia collects neither an estate tax nor an inheritance tax.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

That means if you inherit property either real property personal property or intangible property like. There is no federal inheritance tax but there is a federal estate tax.

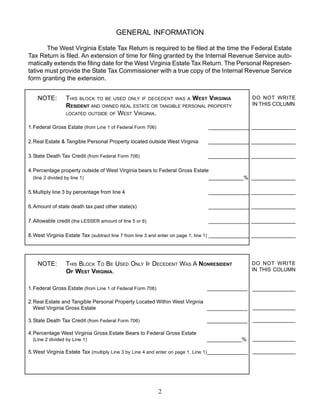

Estate Tax Return Chap 11 Article 11 Decedents Who Died After Ju

New Jersey Estate Tax Changes Mccarthy Weidler Pc

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

What Is Inheritance Tax Probate Advance

Where Not To Die In 2022 The Greediest Death Tax States

West Virginia Retirement Tax Friendliness Smartasset

Severance Taxes Urban Institute

Estate Tax Return Chap 11 Article 11 Decedents Who Died After Ju

West Virginia Income Tax Repeal Evaluating Plans Tax Foundation

West Virginia Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Software Systems Inc Property Tax Inquiry

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Creating Racially And Economically Equitable Tax Policy In The South Itep

Everything You Need To Know When Moving To West Virginia

Free West Virginia Small Estate Affidavit Form Pdf Eforms

Estate And Inheritance Taxes By State In 2021 The Motley Fool

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc